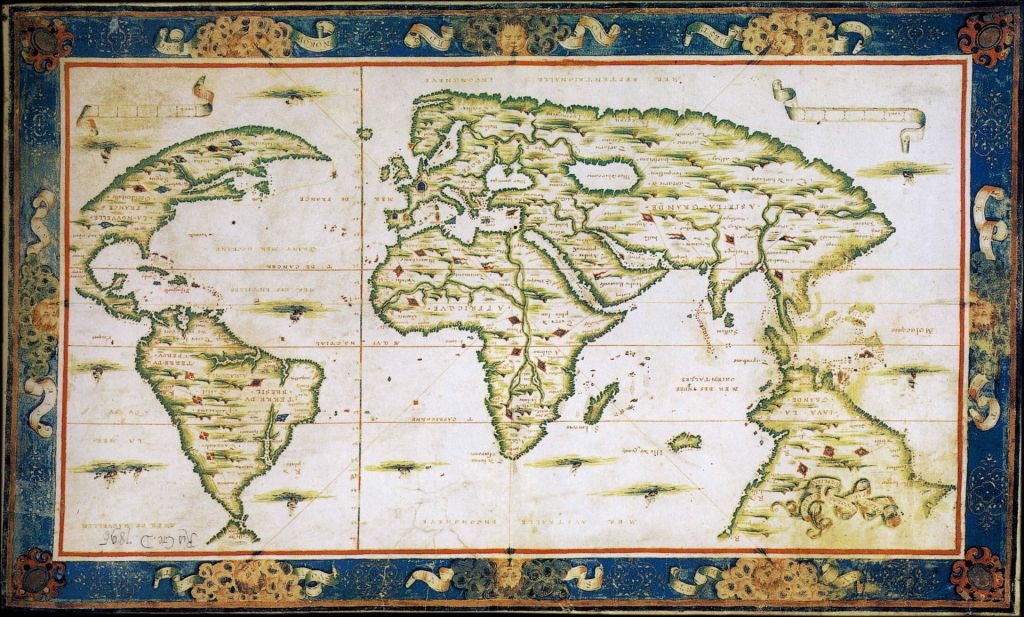

Below is a world map prepared in Dieppe, France showing a large land mass to the south of Indonesia, 50 years before Janzoon ‘discovered’ Australia in 1606

“History is a set of lies agreed upon” – Napoleon Bonaparte

Which European nation first discovered Australia? Was it the Dutch, Spanish or Portuguese?

Several books have been written about the ‘hidden’ discovery of Australia by the Spanish and Portuguese. However, there is no conclusive evidence that these two nations discovered Australia before the Dutch in 1606. Unsurprisingly the ‘evidence’ of the Portuguese being the first Europeans to visit Australia is extremely thin. The ‘evidence’ was ‘conveniently’ lost in the Great Lisbon Earthquake of 1755 and when India annexed the Portuguese colony of Goa in 1961. The Portuguese arrived in Timor in 16th Century and it is less than 250 nautical miles from the Australian continent so it is plausible that they ‘discovered’ northern Australia.

However, the legend persists that the Portuguese were the first European visitors to Australia. One of the enduring legends is that of the Mahogany Ship, a wreck in the sand dunes in south-west Victoria, on the opposite side of the Australian continent to Timor, the nearest Portuguese colony. In the 1830s or 1840s a wreck was apparently sighted by some residents of the area. Even the position of the wreck was recorded. Mysteriously extensive searches using sophisticated technology and the offer of a $250,000 reward by the Victorian state government have failed to locate the wreck.

So, does the Mahogany Ship exist?

Highly unlikely!

Apparently, the original ‘discoverer’ of the wreck was not in Victoria at the time of ‘the discovery’, and he was a criminal with a history of dishonesty. In 1876 a Captain Mason wrote a letter claiming that he’d seen the wreck and that it could have been mahogany or cedar, and the mahogany story stuck. The suggestion of a mahogany ship fuelled the theory it could be Spanish or Portuguese, as it was a timber used by their shipbuilders for centuries.

Furthermore, a large majority of “eyewitness” accounts of the Mahogany Ship conveniently emerged after the wreck had been supposedly swallowed up by the sand dunes around 1880. A 1977 a book called “The Secret Discovery of Australia” further added fuel to the legend. Sealers inhabited the southwest area of Victoria during the period in which the wreck was ‘discovered’. The original ‘discoverer’ was a sealer whose boat capsized and as he walked back through the dunes with his companion they came upon the wreck. There probably was a wreck. If there was it was more than likely a sealers’ boat or possibly a boat stolen by escaped convicts in Tasmania. Timber allegedly from the wreck has been tested and identified as eucalyptus, not mahogany.

So, like many legends, the Mahogony Ship story has been built on half-truths, mistakes, exaggerations and lies and takes on the form of an ‘urban myth’. This has not stopped the local council in Warrnambool from erecting a Portuguese Explorer’s Memorial in a local park linking it to the legend of the Mahogony Ship! Never let the truth get in the way of a good story.

For more than 28 years the Portuguese speaking communities of Victoria have been coming to the city of Warrnambool to celebrate what they believe to be the discovery of Australia by Portuguese navigators. The Warrnambool Portuguese Cultural Festival is held every two years and celebrates the historical ties between Portugal and Australia, based on the legend of the mysterious Mahogany Ship.

“We are very happy to have the Portuguese community here every two years; we want the festival to get bigger and better. We also want to keep the Mahogany Ship buried in the dunes, we don’t want to dig it out and spoil the mystery, this is great for our city,” said Cr Robert Anderson, Mayor of Warrnambool.

Are there lessons here for managers in the legend of the Mahogany Ship?

- Don’t believe everything you are told by customers, staff or owners

- Go back to first principles to determine what are the facts – are they actually facts?

- There is nothing like telling a story to sell an idea even if it is not correct. The romantic idea of Australia’s first European visitors being Portuguese not British has certainly helped fuel the legend. The local council has profited through the story – it brought visitors to the area.

Note: the first recorded European visit was Dutchman Willem Janzoon in 1606 who landed on Cape York and chartered 300 km of coastline.

#thenetworkofconsultingprofessionals